An Alternative News Aggregator

News of the Day

“Glory to God in the highest heaven, and on earth peace to those on whom his favor rests.”

- Luke 2:14

Mass. Bill Would Bar Guard Deployments From Out of State

Metro Los Angeles Forced to Reallocate Buses with 'Melania' Movie Ads After Grotesque Vandalism

Metro Los Angeles chose to relocate advertising for First Lady Melania Trump’s documentary after the posters were vandalized. Fox affiliate KTTV-TV reporter Matthew Seedorff posted on social media that Metro […]

The post Metro Los Angeles Forced to Reallocate Buses with 'Melania' Movie Ads After Grotesque Vandalism appeared first on The Western Journal.

Chinese Belt and Road Loans in Freefall as Beijing Squeezes Every Last Cent Out of Africa

China’s massive Belt and Road Initiative (BRI) appears to be flagging in Africa, as new loans for infrastructure projects are down by over 50 percent – and more money is now flowing from African debtors to Chinese banks than the reverse.

The post Chinese Belt and Road Loans in Freefall as Beijing Squeezes Every Last Cent Out of Africa appeared first on Breitbart.

NURSE SHARKS: Why Are These Nurses Threatening to Harm People?

Across the country, nurses appear to be taking up arms—or rather, syringes—in the name of opposing Immigration and Customs Enforcement or President Donald Trump.

Hospitals and authorities have quickly responded to prevent any harm, but the trend suggests nurses might seek to weaponize their profession to advance their political views.

The largest nurses’ union has called for the abolition of ICE.

Injecting ICE

On Tuesday, Virginia Commonwealth University Health announced that it fired a nurse after she released social media videos urging medical providers to use a “sabotage tactic” against ICE, preparing syringes with saline or succinylcholine, a muscle relaxant that can cause temporary partial paralysis.

“Following an investigation, the individual involved in the social media videos is no longer employed by VCU Health,” the hospital told Fox News Digital. “In addition, VCU Health has fulfilled its reporting requirements under Virginia state law.”

The hospital previously said it and VCU Police opened an investigation into the nurse.

No Anesthesia for Trump Supporters?

Erik Martindale, a registered nurse in Florida, posted on Facebook that he would deny anesthesia for “MAGA” patients, those in the Make America Great Again movement. He later deleted the post and claimed his account had been hacked.

“I will not perform anesthesia for any surgeries or procedures for MAGA” he wrote in the now-deleted post. “It is my right, it is my ethical oath, and I stand behind my education. I own all of my businesses and I can refuse anyone!”

Florida Attorney General James Uthmeier alerted the Florida Board of Nursing to Martindale’s post.

Wishing Pain on Karoline Leavitt

White House press secretary Karoline Leavitt announced last month that she is pregnant with her second child.

Lexie Lawler, who worked as a labor and delivery nurse at Baptist Health Boca Raton Regional Hospital, posted a social media video saying, “As a labor and delivery nurse, it gives me great joy to wish Karoline Leavitt a fourth-degree tear.”

The “fourth-degree tear” she mentioned refers to a painful and severe childbirth injury requiring surgical repair.

The hospital fired the nurse, saying the statements “do not reflect our values.”

“While we respect the right to personal opinions, there is no place in health care for language or behavior that calls into question a caregiver’s ability to provide compassionate, unbiased care,” a spokesperson said.

Uthmeier announced Wednesday that Florida Surgeon General Joseph Ladapo had revoked Lawler’s nursing license.

Lawler appears unrepentant. She launched a fundraiser, claiming that she was “fired for political speech.” She has raised more than $13,000 as of Thursday afternoon.

“If you believe liberal women shouldn’t lose their livelihoods for refusing to tone it down, stand with Lexie,” the campaign states.

National Nurses United

While these cases appear disconnected, America’s largest union of nurses released a statement demanding the abolition of ICE.

National Nurses United, which claims to represent 225,000 nurses, condemned the agency following the shooting death of Alex Pretti at the hands of U.S. Border Patrol agents. The agents have been placed on leave amid an investigation.

“The nation’s nurses, who make it their mission to care for and save human lives, are horrified and outraged that immigration agents have once again committed cold-blooded murder of a public observer who posed no threat to them,” the union said in a statement after the shooting Saturday.

“ICE and all related immigration enforcement agencies have repeatedly shown through their violence, terror, and lawlessness that they pose a dire public health threat to the entire country and all our communities,” the union added. “Nurses demand the immediate abolition of ICE.”

The union called for a no vote on the Homeland Security appropriations bill, and pledged to do “everything in our power to vote out any elected official who supports funding for this all-out assault on the health, safety, and civil rights of our people.”

Harm of Politicizing Medicine

Dr. Kurt Miceli, chief medical officer at Do No Harm, emphasized the damage that politicization poses to medicine.

“As we’ve documented at Do No Harm, if medical schools, associations, and hospitals allow radical politics to influence curricula and training, then they shouldn’t be surprised when they produce harmful activists rather than skilled medical professionals,” Dr. Miceli, a board certified physician in psychiatry and internal medicine, told The Daily Signal in a statement Thursday.

“Healthcare professionals who make violent threats against government employees, political supporters, or public officials abandon the ethical core of their profession and forfeit the trust essential to practicing it,” he added. “Their conduct illustrates how deeply ideological activism has warped the culture of care.”

“Medicine must remain anchored in the duty to treat the patient, keeping politics out of the clinical encounter and rejecting any rhetoric or behavior that compromises ethical practice,” Miceli concluded. “Patients deserve care grounded in ethics, competence, and respect—not animus or politics.”

The post NURSE SHARKS: Why Are These Nurses Threatening to Harm People? appeared first on The Daily Signal.

Watch Live: Donald Trump Signs Executive Order to Address Drug Addiction

President Donald Trump signs an executive order at the White House addressing drug addiction on Thursday, January 29.

The post Watch Live: Donald Trump Signs Executive Order to Address Drug Addiction appeared first on Breitbart.

12 Most Insidious Secret Jewish Plots Revealed

Everyone knows by now that the Jews are behind everything that happens in the world, but there are far more nefarious plots they are orchestrating that you don't even know about.

Tim Walz Insinuates Fatal ICE Shootings Are Kicking Off a Civil War

Minnesota Gov. Tim Walz is suggesting that federal enforcement of federal law in his state may trigger a Civil War.

The post Tim Walz Insinuates Fatal ICE Shootings Are Kicking Off a Civil War appeared first on Breitbart.

DC Residents Allegedly Ignored And Abandoned After Snowstorm

Dem Who Called Girls ‘F*cking C*nts’ For Allegedly Posing With ICE Loses Two Jobs

Raging Leftist Keith Olbermann Shows His True Colors, Smears Melania Trump Over Her Accent

Leftists love immigrants — as long as those immigrants don’t love President Donald Trump. Keith Olbermann, one of the most vacuous voices on the modern left, proved that in a […]

The post Raging Leftist Keith Olbermann Shows His True Colors, Smears Melania Trump Over Her Accent appeared first on The Western Journal.

Nicki Minaj Blasts Gavin 'Newscum' at Trump Event: Bessent 'Obliterated' Him

Washington, DC — Rap icon Nicki Minaj shaded the far-left governor of California during a Trump administration event on Wednesday, calling him Gavin "Newscum" and saying Treasury Secretary Scott Bessent "obliterated him" in his recent World Economic Forum speech.

The post Nicki Minaj Blasts Gavin ‘Newscum’ at Trump Event: Bessent ‘Obliterated’ Him appeared first on Breitbart.

DHS Responds After Judge Accuses ICE of Violating 96 Court Orders in Minnesota

The Department of Homeland Security responded to criticism from a federal judge who claimed that Immigration and Customs Enforcement had violated 96 court orders in 74 cases.

Patrick Schiltz, chief judge of the U.S. District Court for the District of Minnesota, had originally demanded that ICE give a detained immigrant a bond hearing within seven days. After the agency initially defied his order, he commanded acting Director Todd Lyons to appear before him to explain why he should not be held in contempt of court.

The agency then released the detained immigrant and Schiltz dismissed his order, but not before issuing a scathing rebuke claiming that ICE had violated 96 court orders.

DHS Assistant Secretary Tricia McLaughlin responded Thursday and did not contradict the list of allegedly violated orders. She did highlight that the judge dismissed his order that Lyons appear in court.

“If DHS’s behavior was so vile, why dismiss the order to appear?” McLaughlin told The Daily Signal in a statement. “Despite the diatribe from this activist judge, the only order involved with this case issued yesterday was that Acting Director Lyons was no longer ordered to appear to testify in court.”

“DHS will continue to enforce the laws of the United States within all applicable constitutional guidelines,” she added. “We will not be deterred by activists either in the streets or on the bench.”

Condemning ICE

Schiltz, an appointee of President George W. Bush, rebuked ICE as part of his dismissal of Lyons’ order on Wednesday.

“Attached to this order is an appendix that identifies 96 court orders that ICE has violated in 74 cases,” the judge wrote. “The extent of ICE’s noncompliance is almost certainly substantially understated.” The list includes orders issued since Jan. 1.

“ICE has likely violated more court orders in January 2026 than some federal agencies have violated in their entire existence,” Schiltz wrote.

“ICE is not a law unto itself. ICE has every right to challenge the orders of this Court, but, like any litigant, ICE must follow those orders unless and until they are overturned or vacated.”

Immigration Courts

The case revolves around questions of ICE’s ability to detain illegal aliens. Schiltz ordered ICE to provide the immigrant a bond hearing under 8 U.S.C. Section 1226(a).

Immigration courts inside the executive branch often handle immigration cases, yet lawyers for illegal aliens pursue cases in Article III courts, instead.

Lora Ries, director of The Heritage Foundation’s Border Security and Immigration Center, told The Daily Signal that the Trump administration is using mandatory detention to avoid releasing illegal aliens, and the administration has a strong policy case for this.

“Similar to the Remain in Mexico program that the Trump 45 administration was the first to use—despite the authority becoming law in 1996—this Trump administration is increasing the use of mandatory detention per the same law to prevent ‘catch and release,’” Ries said. “The administration is on strong legal and policy grounds.”

“Detained aliens can still pursue immigration benefits like asylum or other relief from deportation,” she noted. “The fact that detained deportable aliens are running to federal court is yet another example of deportable aliens using our court systems to delay their removal.”

The post DHS Responds After Judge Accuses ICE of Violating 96 Court Orders in Minnesota appeared first on The Daily Signal.

Marco Rubio Bans Senior Iranian Officials From US Soil

Trump Signs Executive Order to Fight Drug Addiction

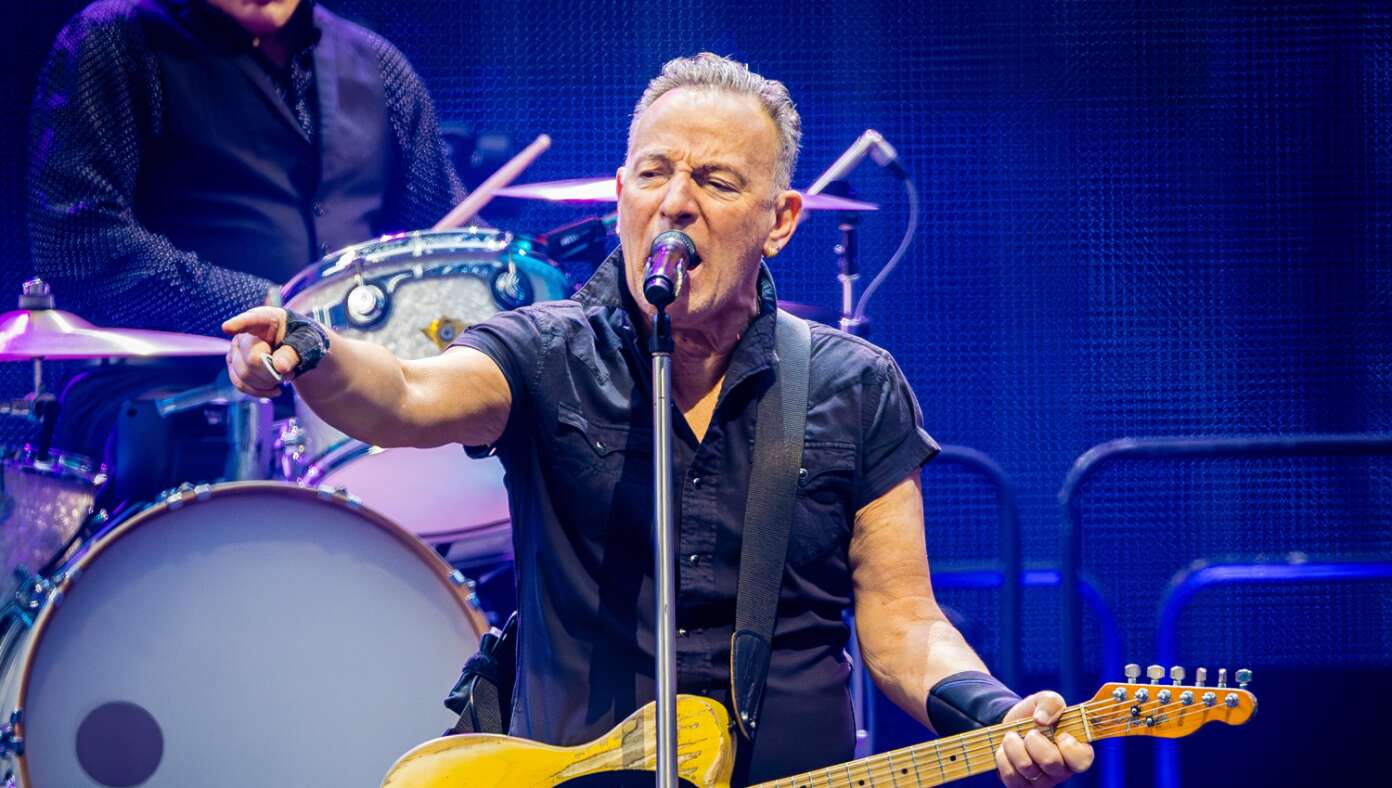

Bruce Springsteen Threatens To Keep Releasing Songs Until Deportations Stop

COLTS NECK, NJ — After putting out a new song titled "Streets of Minneapolis" as a show of support for anti-ICE protesters, musician Bruce Springsteen issued a statement threatening to keep releasing songs until deportations were stopped.